Likelihood of special session grows, as tax policy package stalls

Supporters and opponents of the bill voice their positions on the final day of the 60-day session

BEATRICE – It’s appearing more likely that the Nebraska Legislature is headed toward a special session on tax relief.

Lawmakers were butting heads on the final day of the 60-days legislative session, over a tax policy measure some see as providing property tax relief, while others call it the biggest tax increase in Nebraska history.

Senator Julie Slama, who is wrapping up her stay in the Legislature, said her constituent contact leans heavily against LB 388. "We're gonna be stuck working with each other this summer, some time, for a special session...to either address this issue or some other issue...and that's okay. I would rather handle this specific issue....our tax code....in a longer process, over a special session when it's the one thing we're focused on. And to all the senators who are getting pressure one way or the other and being told you won't get reelected if you don't vote blank....vote what you believe in. Get up, stand tall for what you believe in, and I don't care what color you put up on the board, whether it's green or red. But don't you dare put a color up on that board because someone told you to, or threaten you. You're here to represent your district."

Slama said a vast majority of Nebraskans opposed raising sales taxes to provide property tax relief. Slama offered a floor amendment to strike the enacting clause on the bill.

Revenue Committee Chair, Senator Lou Ann Linehan said there’s been a lot of misinformation about LB 388. She rejected a description of the bill as the largest tax increase ever. "The idea that this is a tax increase.....here's the numbers, guys. Locals collect over five billion dollars in property taxes....up a billion from when my class got here. We collect about three, in income taxes. And, we collect two, in sales taxes."

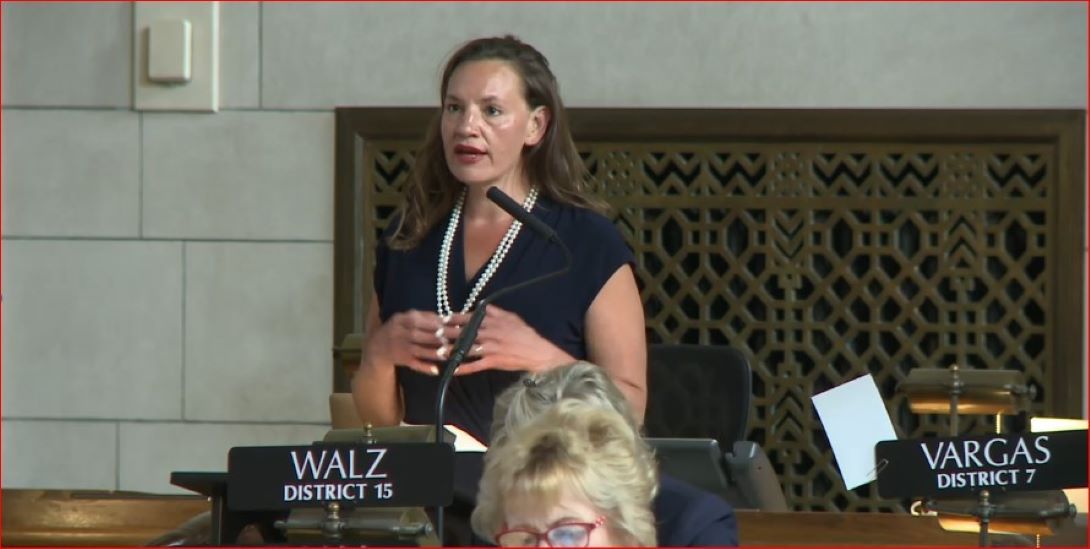

Senator Danielle Conrad said Nebraskans don’t support increasing taxes in order to cut taxes. "Pure and simple...a vote for cloture is a vote for one of the largest tax increases in Nebraska history, there's no other way to characterize it....as is a vote for the bill. We still don't have a clear sense of what we're voting on. We don't need to rush forward and jump off a cliff, together. We shouldn't fear a special session. We should embrace it. We should hit pause today...we should use our minds, our common sense, our hearts and what our constituents are telling us....to turn back increases in taxes on most Nebraskans.....go back to the drawing board this summer, roll up our sleeves and get it right."

Senator Mark Jacobsen supports LB 388 and said the one common theme that has repeated itself…is the need to lower property taxes. "We talk about tax shifts. There's a tax shift going on now, and it's been going on for ten years. It's a shift to property taxes. Sixty percent of it is going to public schools, which have to comply with state and federal mandates to educate children. That burden is on our local property taxpayers. The state provides some through TEOSSA....and as of last year, some through foundation aid. But, that's largely borne by local property taxpayers....and they're sick of it."

Senator Tom Brandt of Plymouth supported LB 388 and said it’s wrong to assume that it only helps farmers with property tax relief. LB 388 proposed front-loading income tax credits toward property taxes people pay to fund education. It would tax soda and candy, increase the tax on cigarettes, and put in place a three-percent hard cap on local governments.

At late morning, Linehan asked that LB 388 be passed over and that the body proceed to other bills on final reading. The request was honored by Speaker John Arch.